This post originally appeared on Nooga.com

By: Todd Henon

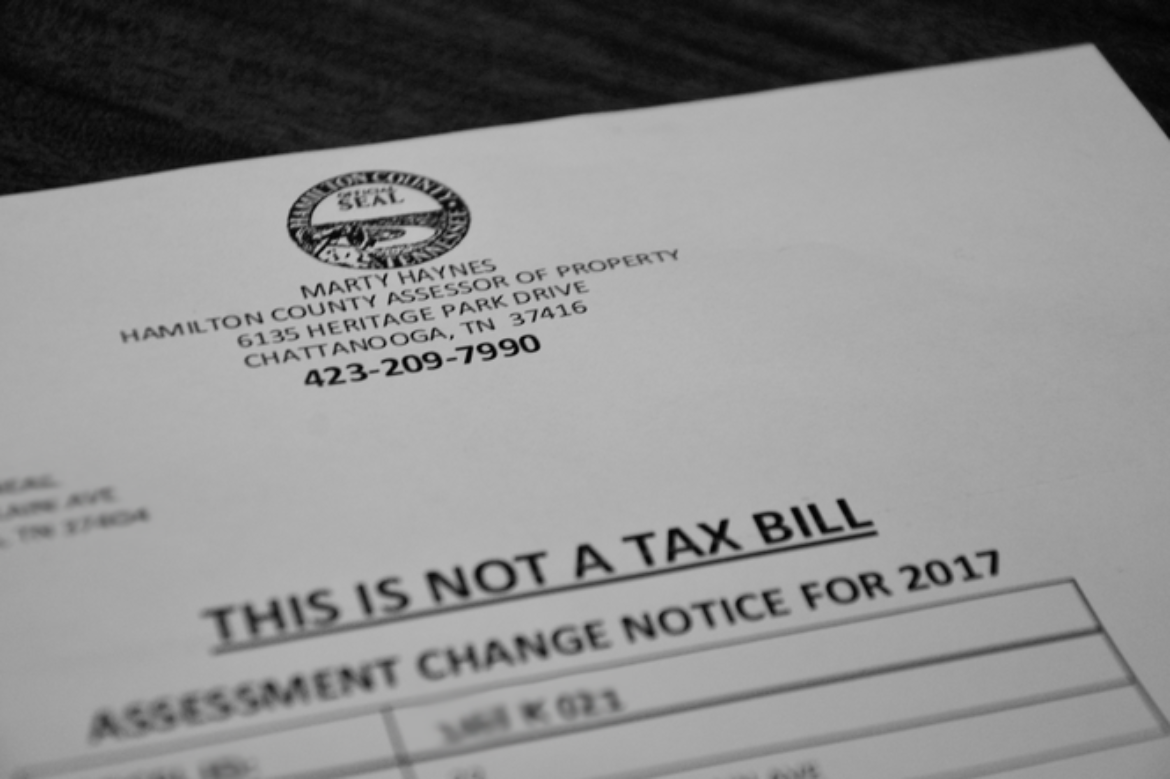

If you haven’t already, you will one day soon open your mailbox to find your property appraisal and assessment from Hamilton County Assessor of Property Marty Haynes. Like many people, you may wonder what the heck it means.

The assessor is not the “tax man”; the appraiser’s office is the government agency that tracks ownership and sales events, and assigns or “appraises” the value of your property. (This is not the same appraisal done in the context of a sale or refinance event.)

Your reaction to this piece of mail may vary from excitement that your property’s value is higher than it was a few years ago to dismay that your property tax amounts may be going up to “I’m going to just trash this since it’s marked ‘not a bill.'”

Firstly, it is indeed not a bill. Your property tax bill arrives in your mailbox in October, with a due date of Feb. 28 of the following year. Your property appraisal and assessment notice is like an “FYI” communicating to you the result of a four-year cycle where all properties in Hamilton County are reappraised. It is a resetting—a recalibration, if you will—of what your property is worth according to the assessor of property’s office.

Secondly, the estimate is not necessarily what your property’s retail value is (though it could be close). It is not uncommon for the true retail value and the property assessor’s appraised value to be different. The assessor’s estimate is not done in a vacuum. They estimate value based on comparable sales in your ZIP code, neighborhood and general geographic area. The assessor’s office is very good at its job, but certainly not perfect. If you have questions around your property’s appraised value, it may be wise to pick the phone up and call the assessor’s office. You will find them helpful and willing to answer your questions. Additionally, consult a qualified Realtor to weigh in and provide his or her opinion of current market value.

Although it may often be our inclination to resist a rise in taxes, in this scenario, a rise in appraised value and the assessment amount is generally a good thing. It indicates your property values may very well be increasing.

In summary, whatever the new number on your assessment is, don’t panic. If the appraised value is increasing, be grateful. It could bode well for your resale value. If the value is decreasing, enjoy your tax savings and check in with a knowledgeable real estate agent for more detail on current street value and ways to maximize your property investment.

More from Todd Henon Properties Team

423.664.1914 | ToddHenon.com

For more than 20 years, Todd Henon Properties has delivered the highest standard of intelligent, fair, and reliable service, nurturing lasting relationships though our unquestionable value and loyalty.

When you’re ready to SELL, BUY, or EXPLORE, we’re here for all the seasons of your life.

Contact Us

Search For Properties

View Featured Properties

Like Todd Henon Properties on Facebook

Follow Todd Henon Properties on Instagram